![]()

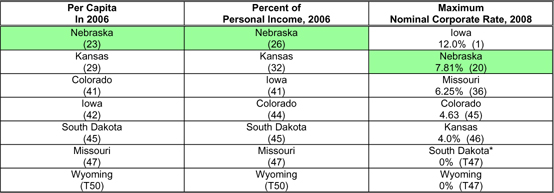

CORPORATE INCOME TAX RANKINGS

* South Dakota has a bank tax rate of 6%.

Columns 1 and 2: U.S. Bureau of the Census, State and Local Collections (2006) as calculated and ranked by the Legislative Fiscal Office.

Column

3: Federation of Tax Administrators, January 2008, www.taxadmin.org.

As the table above demonstrates, Nebraska was ranked in middle nationally in corporate income tax collections on a per capita basis or as a percent of personal income in 2006. However, all of the neighboring states were ranked much lower. These rankings are also quite volatile. Our rankings increased from 29th and 30th in 2002 to 21st in 2004, back down to 25th and 29th in 2005, and increased again to 23rd and 26th in 2006. Kansas dropped from 23rd highest in per capita collections in 2000 to 45th in 2002. Colorado fell from 32nd to 46th over the same time period while Iowa rose from 36th to 30th. These rapid swings are likely the result of changes in conditions for particular large businesses or important industries from year to year rather than legislative action. Our top nominal rate of 7.81% ranks 20th in the nation and higher than the surrounding states, except Iowa. As described elsewhere in this section on corporate income taxes, the tax is declining in significance across all states in the United States for a variety of reasons. |